Understanding Real Estate Taxes: What Every Homeowner Should Know

Understanding Real Estate Taxes: What Every Homeowner Should Know

Real estate taxes—sometimes called property taxes—can feel like a mystery when you first buy a home. But understanding how they work is key to managing your budget and avoiding surprises down the road. Let’s break down what every homeowner should know about this important part of homeownership.

What Are Real Estate Taxes?

Real estate taxes are annual fees that homeowners pay to local governments. These taxes help fund essential community services like schools, police and fire departments, road maintenance, parks, and libraries. In short, your tax dollars help keep your neighborhood running smoothly!

How Are They Calculated?

The amount you owe is based on your property’s assessed value and the local tax rate. Here’s how it works:

- Assessed Value: This is the value your local government places on your home for tax purposes. It may not match your home’s market value, but it’s usually based on similar sales in your area and property features.

- Tax Rate: Often called a “mill rate,” this is set by your city, county, or township. The rate can change from year to year based on local budgets and needs.

For example, if your home is assessed at $300,000 and your local tax rate is 1.5%, your annual property tax bill would be $4,500.

When and How Do You Pay?

Most homeowners pay real estate taxes either directly to their local tax office or through their mortgage lender, who collects the money monthly as part of your mortgage payment and pays the bill on your behalf. Be sure to check your mortgage statement or contact your lender to see how your payments are handled.

What If Your Taxes Go Up?

Property taxes can increase if your home’s assessed value rises or if the local tax rate goes up. If you think your assessment is too high, you may have the right to appeal. Check with your local tax assessor’s office for details on how to start the appeal process.

Tax Breaks and Exemptions

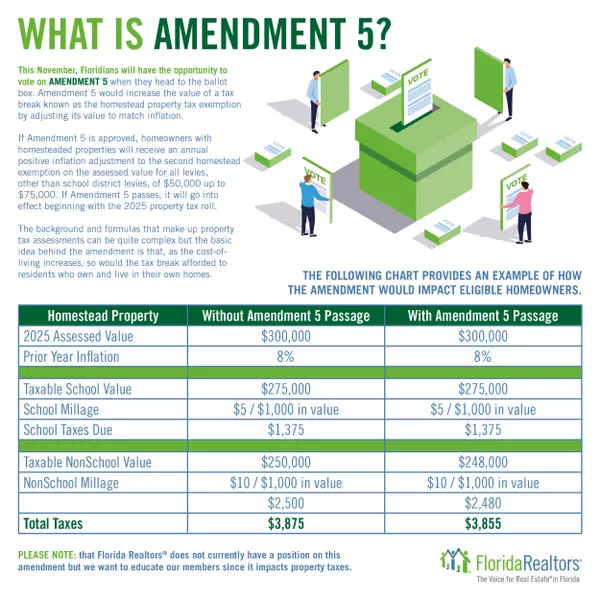

Many areas offer tax relief programs for seniors, veterans, people with disabilities, or homeowners who use their property as a primary residence. It’s worth researching what’s available in your community—you could save hundreds or even thousands of dollars each year!

Final Thoughts

Real estate taxes are a fact of life for homeowners, but understanding how they work can help you plan ahead and avoid unwelcome surprises. Stay informed, review your annual tax assessment, and don’t hesitate to ask questions if something doesn’t seem right. Your home is one of your biggest investments—protect it by staying on top of your property tax responsibilities!

Categories

- All Blogs (58)

- 1031 Exchange (2)

- downpayment assistance (4)

- first-time homebuyers (21)

- florida homes (39)

- Golf Course Homes (2)

- Home Maintenance (3)

- Home Safety (6)

- Homeownership (47)

- Hurricane Preparedness (3)

- Increase your home value (3)

- Landscaping Tips (2)

- mortgage (9)

- real estate investors (8)

- Real Estate Taxes (5)

- tips for buyers (26)

- tips for sellers (12)

- tips for seniors (17)

- veterans (22)

Recent Posts